Can your clients risk NOT having Cyber Insurance coverage?

Do Your Customers Know What a Data Breach Could Cost Them?

Hint: It could be everything

WARNING The Results May Be Shocking

Sure, your clients might know that there are "some" monetary repercussions of suffering a data breach, like the costs associated with notifying the individuals involved, but what about the rest? Will they rely on word of mouth or referrals? Customers may not be so quick to refer a company that compromised their data.

Your Customers Are At Risk

SMBs account for 43% of data breaches

Lack of time, resources and education are three major factors that put small to medium-sized businesses (SMBs) at risk.

2019 Data Breach Investigations Report

83% of SMBs lack the funds to recover

What's worse? A quarter of those who can't afford it didn't even realize there would be any recovery costs involved.

2018 InsuranceBee Cybercrime Survey

79% of MSPs report ransomware against SMBs

That means almost 80% of MSPs are going to have to help their clients respond to an incident. And who will they blame? Unfortunately, their IT provider.

2018 Datto State of the Channel Ransomware Report

Phishing emails account for 66% of ransomware cases

Even when 65% of MSPs reported having spam filters in place, cybrecriminals can still get in. The takeaway? A layered security approach is no longer optional.

2018 Datto State of the Channel Ransomware Report

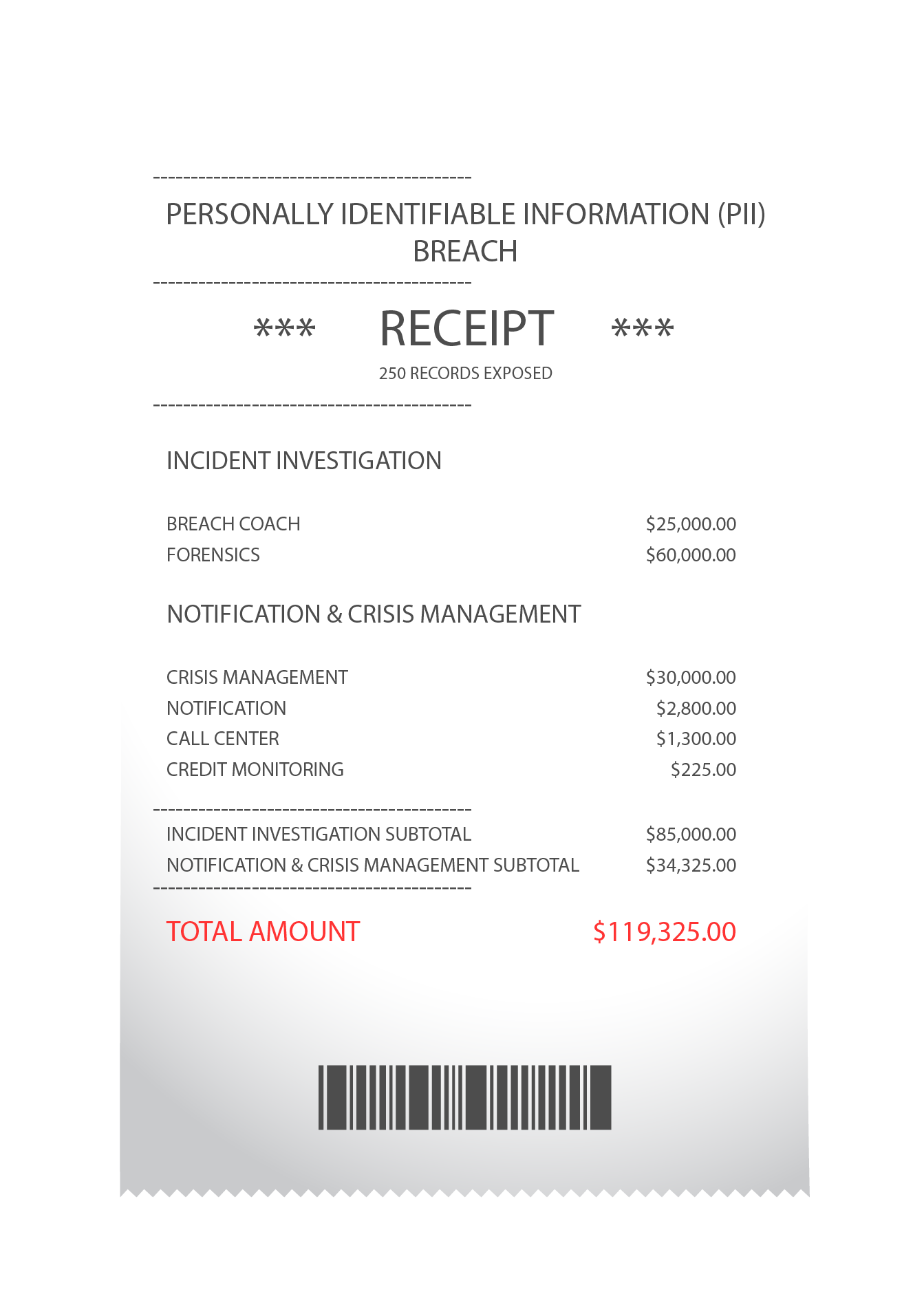

How to Calculate Breach Costs

Enter the number of customers' data that could be exposed and choose between three types of data breaches:

Press "Calculate" to see what a breach could cost! Hover over any of the associated costs to learn more.

Proactive Prevention & Protection

It's been proven that a comprehensive and continuous security education program can effectively reduce phishing click rates by up to 64%. With phishing being one of the top attack methods used by cybercriminals, investing in a phishing and education program has been shown to output a 37-fold Return on Investment.

Ponemon Institute. “The Cost of Phishing & Value of Employee Training.”

How Can Cyber Insurance Help?

Exploitation

Cybercriminals access your customer's network by leveraging human error. From fraudulent wire transfers to ransomware, they're covered.

Investigation & Notification

Security incident? Time to investigate exactly who and what was compromised through verified vendors that will guide your customers from investigation to notification.

Crisis Management

Who wants to work with a company that lost customer data? Don't worry, the damage can be handled with experienced PR support, provided for your customers.

Financial Support

All these costs add up, how can your customers afford it? With cyber insurance, they don't have to. From fines & penalties to legal and liability expenses, they're covered.

Why Cyber Insurance?

But my customers have business insurance...

Unfortunately, not all standard business insurance policies cover cyber events like data breaches, ransomware, and business email compromise, or the expenses associated with them. It's important for businesses to understand what coverage is included in a cyber insurance policy so they can be sure to choose the one that best fits their business needs.

My customers are small, they're not at risk!

We wish it was that easy! 64% of small to medium-sized businesses surveyed reported suffering a cyber-attack. What's worse? Less than 2% believe the attack had no impact on their business. Most common hurdles after an attack? Money, time/effort, and data loss.

Underserved and Unprepared: The State of SMB Cyber Security in 2019

How do I know if my customers need cyber insurance?

Do they collect payment information online? Have a database of personal information? Digitally store employee information like Social Security numbers? Located in any of the 50 United States each with differing Breach Notification Laws? If you answered yes, then they should have a cyber insurance policy.

Protect your clients from going out of business

Don't wait until it's too late. We've got the proper proactive measures that can not only minimize the chances of your clients experiencing a cybersecurity incident. Contact us today to go over our white-label, next-to-none security services so we can help you establish a security program that fits your client's needs.

Copyright 2021, Breach Secure Now